From July 1st, 2008 when another 6 states start using the Nationwide Mortgage Licensing System, the NMLS will be in use in total by 14 states. According to Conference of State Bank Supervisors (CSBS) & American Association of Residential Mortgage Regulators (AARMR), the 6 states that are starting to use the NMLS are -

1. North Carolina

2. Vermont

3. Connecticut

4. Mississippi

5. New Hampshire

6. Louisiana

At present forty two state agencies that represent forty states have confirmed their future participation. The eight other states that are presently using the NMLS are -

1. Iowa

2. New York

3. Washington

4. Nebraska

5. Idaho

6. Massachusetts

7. Rhode Island

8. Kentucky

The Nationwide Mortgage Licensing System is a web based system which is used by state-licensed lenders, loan officers & brokers to apply online for license and amend, update or renew it for all the participating state run agencies through only one set of uniform applications.

Right now NMLS is managing following licensed mortgage brokers & lenders -

1. 3557 Branch Locations

2. 16,867 Loan Officers

3. 5145 Companies

This licensing system is used by mortgage regulators to accept & process applications for license and also renewal forms developed by states. Through this system, license holders can manage a single record to apply for, renew, amend & surrender their licenses with any of the state residential mortgage regulators.

Monday, June 30, 2008

Nationwide Mortgage Licensing System Expanding

Monday, June 23, 2008

Increase in annual home foreclosures

According to a report by RealtyTrac, home foreclosures have grown by seven percent in May & have increased by forty eight percent annually and in total there were 261,255 foreclosure filings in May.

According to a report by RealtyTrac, home foreclosures have grown by seven percent in May & have increased by forty eight percent annually and in total there were 261,255 foreclosure filings in May.

Nevada was in the forefront with highest monthly foreclosure rate & 9009 filings. This was a twenty four percent increase from last month & a seventy two percent increase annually.

With 11% monthly foreclosure rate growth , California is next to Nevada and the annual increase was at 81%. Next was Arizona with 12% monthly foreclosure rate growth over last month & a 119% increase annually.

Another important point highlighted in the report is that the bank repossessions have continued their climb & had a double-digit percentage increase as compared to last month. As a result, bank inventories have swelled to over 700,000 homes.

Sunday, June 22, 2008

Operation Malicious Mortgage

The DOJ & FBI in a press conference have announced that they have arrested more than 400 real estate industry persons for incidences of mortgage fraud. These arrests were in Atlanta, suburban Maryland and Chicago among other locations & people arrested included loan originators, borrowers & real estate agents.

With this sweep, code named "Operation Malicious Mortgage" FBI has estimated that about $1 billion of losses resulted because of the fraud schemes that were employed. In these cases the most common type of mortgage frauds that were used were; forgery of documents, misstatement of assets or income, inflated appraisals & misrepresentation of mortgage buyer's intention of using the house as his primary residence.

Saturday, June 14, 2008

Good credit score and mortgage savings

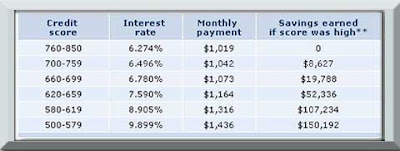

In the following figure we see how much can be saved in mortgage payments if we have good credit score. The last column reflects the amount a person can save over the full term of the mortgage loan if credit score is 760 or higher. The values shown are for national average mortgage rates on a 30 yr frm for a loan of $165,000.

Monday, June 9, 2008

Reward credit cards

Many people wonder about what reward credit cards are, so in this article we will look at some important facts about such cards.

Many people wonder about what reward credit cards are, so in this article we will look at some important facts about such cards.

Use your credit card and be rewarded for it, this is what basically rewards credit cards offer. But such cards have few aspects which consumers should know if they would like to increase benefits on their cards. Some of the important things to keep in mind are, choose the right card, know about the promotional rates, whether rebates are given on daily purchases, & interest rate on such rewards cards.

Selecting the right card is important & nowadays almost all such credit cards offer similar benefits with nearly 95% of such cards offering one percent cash back on your spendings be it by way of points, miles or cash. While selecting a card one has to select a credit card that will offer cash back greater than 1%. Another thing is that it takes a bit of time to earn rewards that can be redeemed for anything valuable so selecting a card which provides rebates on daily purchases is important.

Rewards plastics always have higher rates of interest so in case anyone has to pay interest charges for even 1 month , it will easily wipe off all rewards that might have been earned on the card. So, at the time of applying for such rewards cards one should make sure that he would be able to pay it in full each month.

While searching for more information about such reward cards I found a good site explaining the various merits & demerits of such rewards on credit cards - Benefits of excellent Credit Report. People looking at such rewards cards should go through the article on this site to develop an understanding of how these rewards cards work & what they should be aware of.

Saturday, June 7, 2008

Mortgage delinquency rate at 29 year high

According to National Delinquency Survey by MBA, mortgage delinquency has jumped fifty three basis points in the 1st quarter of this year to 6.35% of all the outstanding mortgage loans from what it was in the previous quarter. More importantly, from 1 year ago, it has increased by 151 basis points.

The report has been developed on the basis of a sample of more than forty four million mortgage loans serviced by commercial banks, credit unions, mortgage companies, thrifts & others.

It has now become the highest delinquency rate ever recorded for the index with the previous high being 6.07%, recorded in 1985.

Jay Brinkmann, who is Vice President, Research & Economics at MBA said that magnitude of this nationwide increase in delinquency rate is driven by certain states & certain mortgage loan types. Brinkmann also added that increase in foreclosure rate has been led by those states which have seen largest decline in prices in the last 2 years.

As per the report total rate of delinquencies rose -

1.For prime rates to 3.71% which was 3.24% in last quarter and

2.For subprime rates to 18.79% which was 17.31% in last quarter.

Also, the total foreclosure rate increased to 2.47%, which was 2.04% in the last quarter.

Credit rating agencies to change core business practices

As per a press release from New York Times, 3 of country's largest credit rating firms, Moody's Investors Service, Fitch Ratings and Standard & Poor's, are going to have an agreement with NY AG, Andrew M. Cuomo to change few of their core business practices because of which these firms were under scrutiny from New York Attorney General's office.

These 3 firms had played a critical role which caused the mortgage securities mess by awarding certain type of security packages Triple-A ratings allowing investors like insurance companies & pension funds to purchase them.

According to the present procedures banks are allowed to shop for suitable ratings as they have to pay only if the rating is acceptable to them. For some years now charges regarding conflict of interest have been raised as investment banks were paying for the credit ratings but earlier, those who were purchasing the mortgage loans, the investors, used to hire & pay for the credit rating services.

According to the proposed agreement, credit rating agencies would be required to stage their fees for all the steps leading up to the credit rating as well as for the credit rating itself. In addition to it, every 3 months the credit rating agencies will have to report on all deals that they were given to rate & all that they actually rated.

Sunday, June 1, 2008

Mortgage debt growth

The following chart shows the total mortgage debt that is outstanding & the steep rise in the outstanding balance we have seen in the last few years which is quite alarming.