Last week Barons as well as The New York Times reported that the 2 GSEs were under considerable pressure to bring in additional capital. In just last week, total losses in value for Fannie Mae was 45% & 30% for Freddie Mac & both have reported $11 billion in losses in the last couple of months. The New York Times reported that if their problems continued Bush administration was taking into consideration plans of their take over and placing them in a conservatorship.

Last week Barons as well as The New York Times reported that the 2 GSEs were under considerable pressure to bring in additional capital. In just last week, total losses in value for Fannie Mae was 45% & 30% for Freddie Mac & both have reported $11 billion in losses in the last couple of months. The New York Times reported that if their problems continued Bush administration was taking into consideration plans of their take over and placing them in a conservatorship.

If any of them is placed in conservatorship, its stock value will be next to nothing and the losses on mortgage loans they guarantee or own will be paid by taxpayers. Right now both companies guarantee or own $5 trillion of debt and about one-half of all residential mortgage loans.

The 2 GSEs are facing difficult situation. If they go for new stock issue for raising capital, they would be diluting shareholder's equity. Right now borrowing costs for both of them have increased as their viability is being reevaluated by debt markets.

Regarding conservatorship, any of the 2 GSEs can be placed into conservatorship if their regulator which is Office of Federal Housing Enterprise Oversight (OFHEO) finds that the GSE is ctitically undercapitalized.

Sunday, July 13, 2008

Fannie Mae & Freddie Mac takeover

Thursday, July 10, 2008

Subprime portfolio by year of issue

In the following chart we see the percentage of subprime portfolio issue in the last few years. As can be seen from the chart, the maxmimum percentage issue has been in year 2004 followed by year 2006.

Monday, July 7, 2008

CIT Group selling home lending business

Recently CIT Group announced that it is selling its manufactured housing division as well as home lending business.

Recently CIT Group announced that it is selling its manufactured housing division as well as home lending business.

The home lending business with total assets at $9.3 billion & its servicing operations will be taken over by Lone Star Funds for about $1.5 billion. Alongwith it they will also assume debts of CIT Group to the tune of $4.4 billion. The manufactured housing division will be acquired for about $300 million by Vanderbilt Mortgage & Finance, Inc.

From April CIT sold its assets in excess of $2 billion & also secured long term financing of $3 billion from Goldman Sachs. CIT Group also declared that it was expecting to report pretax losses of around $2.5 billion in the second quarter in its home lending business.

Chairman & CEO of CIT Group, Jeffrey Peek has said that -

Monday, June 30, 2008

Nationwide Mortgage Licensing System Expanding

From July 1st, 2008 when another 6 states start using the Nationwide Mortgage Licensing System, the NMLS will be in use in total by 14 states. According to Conference of State Bank Supervisors (CSBS) & American Association of Residential Mortgage Regulators (AARMR), the 6 states that are starting to use the NMLS are -

1. North Carolina

2. Vermont

3. Connecticut

4. Mississippi

5. New Hampshire

6. Louisiana

At present forty two state agencies that represent forty states have confirmed their future participation. The eight other states that are presently using the NMLS are -

1. Iowa

2. New York

3. Washington

4. Nebraska

5. Idaho

6. Massachusetts

7. Rhode Island

8. Kentucky

The Nationwide Mortgage Licensing System is a web based system which is used by state-licensed lenders, loan officers & brokers to apply online for license and amend, update or renew it for all the participating state run agencies through only one set of uniform applications.

Right now NMLS is managing following licensed mortgage brokers & lenders -

1. 3557 Branch Locations

2. 16,867 Loan Officers

3. 5145 Companies

This licensing system is used by mortgage regulators to accept & process applications for license and also renewal forms developed by states. Through this system, license holders can manage a single record to apply for, renew, amend & surrender their licenses with any of the state residential mortgage regulators.

Monday, June 23, 2008

Increase in annual home foreclosures

According to a report by RealtyTrac, home foreclosures have grown by seven percent in May & have increased by forty eight percent annually and in total there were 261,255 foreclosure filings in May.

According to a report by RealtyTrac, home foreclosures have grown by seven percent in May & have increased by forty eight percent annually and in total there were 261,255 foreclosure filings in May.

Nevada was in the forefront with highest monthly foreclosure rate & 9009 filings. This was a twenty four percent increase from last month & a seventy two percent increase annually.

With 11% monthly foreclosure rate growth , California is next to Nevada and the annual increase was at 81%. Next was Arizona with 12% monthly foreclosure rate growth over last month & a 119% increase annually.

Another important point highlighted in the report is that the bank repossessions have continued their climb & had a double-digit percentage increase as compared to last month. As a result, bank inventories have swelled to over 700,000 homes.

Sunday, June 22, 2008

Operation Malicious Mortgage

The DOJ & FBI in a press conference have announced that they have arrested more than 400 real estate industry persons for incidences of mortgage fraud. These arrests were in Atlanta, suburban Maryland and Chicago among other locations & people arrested included loan originators, borrowers & real estate agents.

With this sweep, code named "Operation Malicious Mortgage" FBI has estimated that about $1 billion of losses resulted because of the fraud schemes that were employed. In these cases the most common type of mortgage frauds that were used were; forgery of documents, misstatement of assets or income, inflated appraisals & misrepresentation of mortgage buyer's intention of using the house as his primary residence.

Saturday, June 14, 2008

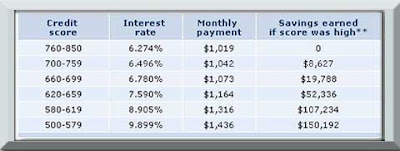

Good credit score and mortgage savings

In the following figure we see how much can be saved in mortgage payments if we have good credit score. The last column reflects the amount a person can save over the full term of the mortgage loan if credit score is 760 or higher. The values shown are for national average mortgage rates on a 30 yr frm for a loan of $165,000.

Monday, June 9, 2008

Reward credit cards

Many people wonder about what reward credit cards are, so in this article we will look at some important facts about such cards.

Many people wonder about what reward credit cards are, so in this article we will look at some important facts about such cards.

Use your credit card and be rewarded for it, this is what basically rewards credit cards offer. But such cards have few aspects which consumers should know if they would like to increase benefits on their cards. Some of the important things to keep in mind are, choose the right card, know about the promotional rates, whether rebates are given on daily purchases, & interest rate on such rewards cards.

Selecting the right card is important & nowadays almost all such credit cards offer similar benefits with nearly 95% of such cards offering one percent cash back on your spendings be it by way of points, miles or cash. While selecting a card one has to select a credit card that will offer cash back greater than 1%. Another thing is that it takes a bit of time to earn rewards that can be redeemed for anything valuable so selecting a card which provides rebates on daily purchases is important.

Rewards plastics always have higher rates of interest so in case anyone has to pay interest charges for even 1 month , it will easily wipe off all rewards that might have been earned on the card. So, at the time of applying for such rewards cards one should make sure that he would be able to pay it in full each month.

While searching for more information about such reward cards I found a good site explaining the various merits & demerits of such rewards on credit cards - Benefits of excellent Credit Report. People looking at such rewards cards should go through the article on this site to develop an understanding of how these rewards cards work & what they should be aware of.

Saturday, June 7, 2008

Mortgage delinquency rate at 29 year high

According to National Delinquency Survey by MBA, mortgage delinquency has jumped fifty three basis points in the 1st quarter of this year to 6.35% of all the outstanding mortgage loans from what it was in the previous quarter. More importantly, from 1 year ago, it has increased by 151 basis points.

The report has been developed on the basis of a sample of more than forty four million mortgage loans serviced by commercial banks, credit unions, mortgage companies, thrifts & others.

It has now become the highest delinquency rate ever recorded for the index with the previous high being 6.07%, recorded in 1985.

Jay Brinkmann, who is Vice President, Research & Economics at MBA said that magnitude of this nationwide increase in delinquency rate is driven by certain states & certain mortgage loan types. Brinkmann also added that increase in foreclosure rate has been led by those states which have seen largest decline in prices in the last 2 years.

As per the report total rate of delinquencies rose -

1.For prime rates to 3.71% which was 3.24% in last quarter and

2.For subprime rates to 18.79% which was 17.31% in last quarter.

Also, the total foreclosure rate increased to 2.47%, which was 2.04% in the last quarter.

Credit rating agencies to change core business practices

As per a press release from New York Times, 3 of country's largest credit rating firms, Moody's Investors Service, Fitch Ratings and Standard & Poor's, are going to have an agreement with NY AG, Andrew M. Cuomo to change few of their core business practices because of which these firms were under scrutiny from New York Attorney General's office.

These 3 firms had played a critical role which caused the mortgage securities mess by awarding certain type of security packages Triple-A ratings allowing investors like insurance companies & pension funds to purchase them.

According to the present procedures banks are allowed to shop for suitable ratings as they have to pay only if the rating is acceptable to them. For some years now charges regarding conflict of interest have been raised as investment banks were paying for the credit ratings but earlier, those who were purchasing the mortgage loans, the investors, used to hire & pay for the credit rating services.

According to the proposed agreement, credit rating agencies would be required to stage their fees for all the steps leading up to the credit rating as well as for the credit rating itself. In addition to it, every 3 months the credit rating agencies will have to report on all deals that they were given to rate & all that they actually rated.

Sunday, June 1, 2008

Mortgage debt growth

The following chart shows the total mortgage debt that is outstanding & the steep rise in the outstanding balance we have seen in the last few years which is quite alarming.

Saturday, May 31, 2008

Hurricane coverage may fall victim to mortgage crisis and credit crunch

Mortgage crisis has created concerns which can impact houseowners. A.M. Best Company, a credit rating organization working for financial industries has speculated that mortgage crisis & credit crunch can affect ability of coverage of claims by insurers & re-insurers which result from coastal disasters.

Mortgage crisis has created concerns which can impact houseowners. A.M. Best Company, a credit rating organization working for financial industries has speculated that mortgage crisis & credit crunch can affect ability of coverage of claims by insurers & re-insurers which result from coastal disasters.

A.M. Best Company has issued a special report in which it has been mentioned that investors are showing less appetite towards capital market offerings which are designed for raising cash to meet claims payments in case any major hurricane strikes the coastal regions.

In the report it has also said that insurers are usually exposed to properties foreclosed by lending companies or abandoned because of the crisis in hurricane-prone regions. According to estimates, over one-half million properties exist in costal regions from Maine to Texas & Florida alone has more than 100,000 properties which are in foreclosure.

State-backed insurance pools which exist in some states such as Texas, Florida & Louisiana can be at more risk. Florida's state-backed reinsurer & its largest insurer are dependent on bond sales after any disaster for coverage of any shortfall & they may not be able to pay all claims arising from any major disaster immediately.

Coastal regions had a respite as there have been no major storms for 2 years, so private insurers were able to rebuild surpluses & capital, particularly in states like Florida. Florida Hurricane Catastrophe Fund is trying to find other ways of building its reserves but if FHCF has trouble raising money then insurers can incur credit risk for reinsurance recoverables which are tied to Florida Hurricane Catastrophe Fund & there can be delay in meeting claims payments for policyholders.

A.M. Best Company in its report also warned that it may be required to rely on federal & state funds if state backed insurers are not able to pay claims.

Friday, May 30, 2008

Acquisition of Bear Stearns by JPMorgan

Federal Reserve Bank of NY has announced that it is going to complete the financing of Bear Stearns's acquisition by JP Morgan by the end of next month (recently shareholders of Bear Stearns have approved investment bank's sale to JP Morgan for $2.3 billion) & also finish portfolio valuation of the investment bank.

NY Fed is making operational arrangements which will be necessary for successful transfer of the portfolios. The portfolio of assets will be properly managed so that recovery value is maximized & disruption in financial markets is minimized.

Tuesday, May 27, 2008

Monthly savings & low APR credit cards

Before taking a mortgage borrowers have to evaluate how much loan they are capable of taking considering the fact that they also have other monthly obligations.

One large portion of our expenses are related to credit card debts and if correct card types are selected having low annual percentage rate (APR) then borrowers can have larger share of their income available for investing in mortgage debt.

Borrowers with good credit scores have more chances of being approved for Low APR credit cards but due to competitive market situations borrowers with average to moderate credit history also stand a chance of being approved for good low apr cards.

One online resource providing more detailed explanation of various low rate credit cards available in the market with their features and also the option to apply online is "http://www.allaboutcredit.net/Low-Rate-Credit-Cards-991373-page.php". Borrowers who really want to streamline their monthly expenditures by reducing how much they pay on their cards & have more savings that can be used in repaying their mortgage debt should go through the details provided in this website.

Sunday, May 25, 2008

Mortgage recovery would be aided by stronger banking regulations

Fed Governor Randall Kroszner has commented that slowly the mortgage market will recover & the main key factor to the recovery will be better risk management.

Kroszner asked banks to take measures to limit the present foreclosure crisis, with less complexity in instruments of credit & greater transparency. According to him partial blame has to borne by investors who got attracted to these structured securities but had no knowledge of underlying risk profiles.

He said that -

Saturday, May 24, 2008

New Fannie Mae Program to help underwater borrowers

This program is for borrowers who owe more on the mortgage loan than its underlying security (the home) is presently worth.

This program is for borrowers who owe more on the mortgage loan than its underlying security (the home) is presently worth.

Under this program existing lenders will not be required to write-down mortgage loans to such a level where refinancing would be feasible. Instead Fannie Mae will refinance new mortgages which would be adequate to cover the existing mortgage debt & refinance will be up to 120% LTV.  This program will cover mortgages which are paid to date & Fannie Mae insures or owns them.

This program will cover mortgages which are paid to date & Fannie Mae insures or owns them.

For borrowers this may result in reduced payment due to reduced rate of interest, slightly extended amortization period or a fixed interest rate and it has been estimated that 150,000 homeowners will get help from this program.

Saturday, May 17, 2008

FHA Housing and Homeowner Retention Act

Federal Housing Administration's bill, H.R. 5830 named as FHA Housing and Homeowner Retention Act was passed by House Financial Services Committe of the House of Representatives recently. This Act will result in availability of around $300 billion for borrowers who are facing foreclosure in the form of federally insured mortgages.

According to this Act, Federal Housing Administration would guarantee a new mortgage for borrowers facing foreclosure if the present lender agrees to accept short payment as full repayment of the mortgage. The new mortgage can be for up to 90% LTV & should have terms that borrower can afford.

After taking the new mortgage if borrower refinances or sells the home, from profits made he will have to pay a declining % of any net proceeds which are related to house appreciation (from 100% in year 1 to 50% in years 4 & beyond) or an exit fee which is equal to 3% of the original amount of the mortgage, whichever is larger.

It is estimated that because of this new Act almost 1.5 million borrowers who are facing trouble with their present mortgage will be benefitted.

Barney Frank (D-MA), who is the Chairman of House Financial Services Committe, targetting mortgage loan servicers said -

Wednesday, May 14, 2008

New rules for lenders proposed by FTC and FED

Federal Trade Commission & Federal Reserve have proposed new rules under which lenders would be required to inform borrowers about changes or unfavorable developments in loan terms.

Federal Trade Commission & Federal Reserve have proposed new rules under which lenders would be required to inform borrowers about changes or unfavorable developments in loan terms.

Under the new regulations, lenders will be provided with the option to divulge borrower's credit risk rating.

In a press release from FED it has ben mentioned that -

Sunday, May 11, 2008

Home improvement loans

Some great deals are available on home improvement loans these days and the money you receive can be used for countless home improvements.

David Ness, a roofing contractor in Boston says he's seen a large increase in his customers taking on large projects with the help of home improvement loans.

Whether you decide to install central air conditioning, remodel a kitchen, or replace a roof this type of loan is a fantastic way to accomplish the work and take advantage of affordable repayments.

Take the time to compare all of the different home improvement loans out there to make sure that you get the best deal for what you would like to achieve. The better the offer, the less your repayments will be and the more you will be able to borrow to make sure the work gets done right.

ARM loan reset schedule

The following graph shows the different type of ARM loans (both securitized as well as non-securitized) due to reset in the coming one year. As can be seen in the graph, in the coming couple of months bulk of ARM resets to happen are for sub prime mortgage loans.

Sunday, May 4, 2008

Prevent more foreclosures

For prevention of more homes going into foreclosure, Randall Kroszner, Fed Governor has said that lenders need to lower interest rates on mortgages & also lower the principal amount for home owners where home prices have gone down below loan value on their loan.

For prevention of more homes going into foreclosure, Randall Kroszner, Fed Governor has said that lenders need to lower interest rates on mortgages & also lower the principal amount for home owners where home prices have gone down below loan value on their loan.

At the time of testifying before HFSP (Home Financial Services Panel), Governor Kroszner urged Congress to take immediate steps for reconciling & enacting FHA modernization legislation which would allow Federal Housing Administration to increase its scale & improve upon management of risks that exists for the government. He also said that GSEs can do more in this regard by increasing their capital & imphasized the need for the government to move ahead with legislation on GSE reform and creation of regulator for GSEs.

Wednesday, April 23, 2008

Can a credit card affect your mortgage approval?

There is no doubt that mortgage market is very unstable right now & lenders are very strict on whom they approve for a mortgage. If you are looking for a mortgage, your credit score and debt to income ratio need to be good.

There is no doubt that mortgage market is very unstable right now & lenders are very strict on whom they approve for a mortgage. If you are looking for a mortgage, your credit score and debt to income ratio need to be good.

I have seen many people spoil there credit score by unplanned use of credit cards, taking too many credit cards and not keeping payments current on them. For lenders your payment capacity as well as payment history is important and such irresponsible use of credit card debt can ruin your chances of getting approved for a mortgage.

Before applying for a credit card there are many things to look into and decide which would be the best option to select. Various websites offer information and guidance on which type of card to select and also the best credit offers presently available in the market.  One such site is www.low-interest-rate-visa-credit-cards.com which has a discussion board named, Immediate credit card care service, where people can post there queries and get answers. There are answers in their databank to plenty of common question that one should be aware of before applying for credit plus the option of posting there own questions if the existing replies do not answer there specific questions.

One such site is www.low-interest-rate-visa-credit-cards.com which has a discussion board named, Immediate credit card care service, where people can post there queries and get answers. There are answers in their databank to plenty of common question that one should be aware of before applying for credit plus the option of posting there own questions if the existing replies do not answer there specific questions.

I spent some time in that section and the answers given there are quite descriptive, not like one liners found in many card help forums. People wishing to get some knowledge about credit cards & the offers presently available should visit this site.

Monday, April 21, 2008

Losses for Wachovia

Wachovia has lost $.20/share or $350 million in the 1st quarter & in comparison it had earned $1.20/share in 1st quarter of 2007. The loss was mainly due to $2.1 billion in setting provisions against credit losses & asset write-downs to the tune of $2 billion.

Wachovia's problems started after it purchased a CA mortgage lender & bank - Golden West for $25.5 billion 2 years back. This acquisition exposed the company to aggressive lending practices & included more emphasis placed on Option ARMs & Interest Only mortgage loans. The bank apart from being hit by increased delinquencies in its mortgage loans mainly in CA, is also facing losses in its credit card, auto & home equity businesses.

Repayment schedule for a 6 year amortized mortgage

The following figure shows repayment schedule for a 6 yr. $1000 amortized mortgage loan having 9% interest for those who are interested in knowing the amortization schedule for such type of mortgages.

Monday, April 14, 2008

Monday, April 7, 2008

Housing Rescue Bill

This bill will help houseowners facing foreclosure. Some of the features of the bill are:

New standard property tax deduction of $500 for individuals and double that for couples who do not itemize deductions.

There will be a $7000 1-year tax credit for purchasing foreclosed homes.

For use as low-income rentals or for buying foreclosed property for reselling, local government to get grants amounting to $4 billion.

For refinancing sub-prime loans, local housing agencies would be able to avail $10 billion in tax exempt bonds & $100 million for expanding counseling for people who are at risk of default.

FHA loans will have down payment requirement up at 3.5% from present 3%.

Fed Discount window for investment banks

Investment banks have borrowed $10.341 billion from Fed's primary dealer credit facility known as discount window. Dealers also borrowed $92.658 billion under TSLF, Term Securities Lending Facility.

U.S. Treasury Securities are lent which have a 28 day term by Term Securities Lending Facility to primary dealers using a auction process.

Sunday, March 30, 2008

Home price decline continues

S&P/Case-Shiller Home Price Indices tracks 2 different indices, ten & twenty metropolitan statistical areas across the country & is released by Standard & Poor's. The report released in January indicates that nationwide price decline for existing family homes has continued into this year also. Sixteen of the twenty metropolitan statistical areas (MSAs) in the survey have reported record declines with 10 of them reaching double digits.

S&P/Case-Shiller Home Price Indices tracks 2 different indices, ten & twenty metropolitan statistical areas across the country & is released by Standard & Poor's. The report released in January indicates that nationwide price decline for existing family homes has continued into this year also. Sixteen of the twenty metropolitan statistical areas (MSAs) in the survey have reported record declines with 10 of them reaching double digits.

Both 20-City & 10-City Composite Indices now report annual declines exceeding 10%. The 20-City has reported a decline of 10.7% & the 10-City a record annual decline of 11.4%.

Just few months back also Miami & Las Vegas were the boom cities, now price-wise, are the weakest cities in January. Miami & Las Vegas have showed decline in prices year-over-year of 19.3% and Phoenix at 18.2% is closely following these two cities in price declines.

Some other metropolitan statistical areas having double-digit price declines include Los Angeles (16.5%), San Diego (16.7%), Detroit (15.1%), Minneapolis (10%), Washington (10.9%), Tampa (15%), & San Francisco (13.2%).

20-City Composite is 180.65 & the 10-City 196.06. With this long view of Home Price Indices data, homeowners in many metropolitan statistical areas are still counting their blessings as some of the worst hit cities as per the present performance are even now showing remarkable appreciation since year 2000, like Log Angeles (224.21), Miami (225.40) & Las Vegas (186.05).

20-City Composite is 180.65 & the 10-City 196.06. With this long view of Home Price Indices data, homeowners in many metropolitan statistical areas are still counting their blessings as some of the worst hit cities as per the present performance are even now showing remarkable appreciation since year 2000, like Log Angeles (224.21), Miami (225.40) & Las Vegas (186.05).In his remarks on survey results, David M. Blitzer, Chairman of the Index Committee at Standard & Poor's said;

Friday, March 28, 2008

Capital requirement for Fannie Mae & Freddie Mac lowered

In a recent development OFHEO (Office of Federal Housing Enterprise Oversight) announced increase in liquidity of the MBS (Mortgage Backed Securities) market by as much as $200 billion.

According to OFHEO, Fannie Mae & Freddie Mac will be allowed to invest a significant portion of the thirty percent capital surplus they have to maintain into mortgages & mortgage-backed securities. Reduction in capital requirements to 20% has been called as "appropriate" by Office of Federal Housing Enterprise Oversight & it may further reduce this capital requirement in future.

In combination with the increase of portfolio caps this reduction in capital requirement will allow the 2 GSEs (Government Sponsored Enterprises) to guarantee or purchase about $2 trillion in mortgage in this current year. This purchasing capacity will allow the 2 GSEs provide assistance in subprime refinancing, loan modification & also do more of jumbo mortgages, for which they have got permission now.

Sunday, March 23, 2008

J.P. Morgan acquires Bear Stearns

J.P. Morgan Chase acquired the investment bank Bear Stearns with a price tag that was a real stunner; it has agreed to pay $2 per share for acquiring Bear Stearns. This purchase price will be paid fully in stock & includes company's forty five storey NY Office Tower. Before the announcement, the price that was talked about was $30 per share. But with $2 per share, the total value of the acquisition, roughly about $236 million is only a fraction of Bear Stearns market value - $3.5 billion.

J.P. Morgan Chase acquired the investment bank Bear Stearns with a price tag that was a real stunner; it has agreed to pay $2 per share for acquiring Bear Stearns. This purchase price will be paid fully in stock & includes company's forty five storey NY Office Tower. Before the announcement, the price that was talked about was $30 per share. But with $2 per share, the total value of the acquisition, roughly about $236 million is only a fraction of Bear Stearns market value - $3.5 billion.

According to The New York Times, Federal Reserve is providing $30 billion credit line to J.P. Morgan Chase which will be secured by Bear Stearns portfolio less-liquid assets like mortgage securities. In a situation these assets lose more value, Federal Reserve will be affected, not J.P. Morgan.

Bear Stearns was known as one of the biggest gamblers of mortgage securities business. It had provided large lines of credit to many subprime lenders & had underwritten Alt-A mortgages. By last month, foreclosure rate on such mortgage was at 15%, about twice to what was the industry average.

Saturday, March 22, 2008

KAMCO to purchase defaulted mortgages in US

Korea Asset Management Corp. has planned to purchase defaulted mortgages in US. KAMCO which is a state-run asset management company was created to settle bad debts of companies which were rescued by government at the time of Asian Financial crisis in 1997-98.

KAMCO has plans of establishing 1 trillion funds in cooperation with financial institutions & local pension funds for investing in US bad debts. It recently sent a group of official with the aim of examining country's debt market & also meet officials of banks run by ethnic Koreans, mortgage lenders & investment banks in LA, NY & FL.

Saturday, March 15, 2008

New GFE and changes in RESPA by HUD

A proposed mortgage reform package was recently released by HUD Secretary, Alphonso Jackson for helping borrowers clearly understand terms of mortgage loan they want to take. If enacted, the changes will reform the GFE & thirty year old RESPA, but before that it has to go through a mandatory period of public comment.

One of the main changes is a proposal that lenders & brokers provide borrowers with a standard GFE. The standard GFE when used will enhance disclosure of major aspects of mortgage loan such as,

a.Interest rate & monthly payments

b.Whether mortgage contains balloon payment or prepayment penalty

c.Whether rate & principal balance can go up, if yes, by how much

The new proposals also specify charges which can & cannot change at settlement and if any fee changes, there will be a limit on the amount by which it can change. Another significant feature in the GFE being proposed is that lender payments to brokers known as yield spread premiums will have to be disclosed.

HUD has also proposed legislative changes in RESPA which will give it authority of imposing penalties if some specific sections of RESPA are violated.

The specific sections for which HUD will have authority would be those which deal with:

a.Loan servicing

b.Referral & unearned fees

c.Prohibition against kickbacks

d.Good faith estimate

e.Settlement cost booklet

f.Title insurance

g.Escrow accounts

HUD also wants that

- Secretaries of State as well as other regulators are allowed to seek equitable & injunctive relief if RESPA regulations are violated.

- HUD-1 be delivered to borrowers 3 days before closing

- A uniform statute of limitations be established which would be applicable to both private as well as governmental actions under RESPA.

Tuesday, March 11, 2008

HomeSaver Advance program from Fannie Mae

HomeSaver Advance program has been announced by Fannie Mae for helping homeowners delinquent on their mortgages and will be available to all Fannie Mae servicers by April 15, 2008. This program is part of Fannie Mae's larger HomeStay initiative & is an excellent solution for borrowers who are in trouble due to temporary events like medical emergencies.

This program is for borrowers who are capable of continuing their mortgage & would be able to resume normal payments if the arrearage is brought current.

Through HomeSaver Advance program the corporation authorizes its servicers to provide unsecured personal loans which can enable borrowers to recover from payment defaults on Fannie Mae securitized or owned mortgage loans. This unsecured personal loan will have fewer up-front costs & could be put in place quickly.

HomeSaver Advance program will provide funds for payment of past due balances of PITI & also up to 6 months (in some instances twelve months) of HOA fees. Advances for attorney fees & escrow advances are also covered but late fees & few other costs are not eligible under this program.

For getting the funds, borrower has to sign a promissory note payable over a fifteen year term with five percent fixed rate of interest. Additionally, no payments are necessary during first 6 months nor does interest accrue in that 6 months period, so the HomeSaver Advance is amortized over a period of 14.5 years.

A delinquent borrower can get lesser of $15,000 or fifteen percent of the original unpaid balance. This amount is directly applied to arrearage & the borrower does not receive the funds in hand. The cost for the borrower will be the $600 workout fee which is to be paid to servicer.

Saturday, March 8, 2008

Proposal to ban use of appraisals arranged by brokers

In a memo distributed to lenders Fannie Mae has proposed ban on use of appraisals arranged by brokers and by a lender's employees.

What this means is that Fannie Mae will not authorize its lending partners to use any appraiser who is an employee of a wholly owned subsidiary. The restrictions will be applicable for mortgage loans which are acquired after Sept. 1. This memo also has reference to setting up of an appraisal clearinghouse to be used for assigning appraisers to any project.

This step is in response to investigations by NY's AG Andrew Cuomo in November last year when Cuomo filed lawsuit against parent company of country's largest appraisal management companies, First American. In the lawsuit they were charged with relaxing their norms under pressure from WaMu, who was a major client & used those specific appraisers who were providing property valuations acceptable by Washington Mutual.

In the original suit Washington Mutual was not included but AG demanded that the 2 GSEs (Freddie Mac & Fannie Mae) appoint independent examiners for reviewing mortgage loans (as well as the underlying appraisals) that they had purchased with emphasis on the ones purchased from Washington Mutual.

Monday, March 3, 2008

Retraining for laid-off mortgage employees

California Governor Arnold Schwarzenegger has proposed initiatives which will utilize various federal & state funds inclusive of $5.6 million federal grant for retraining banking & mortgage workers who were laid off because of mortgage subprime crisis (there has been 8,400 layoffs since last July).

Money for training will be arranged from National Emergency Grant of U.S. Department of Labor. The funds from National Emergency Grant can be used by Department Secretary when unforseen events create urgent need for assistance for unemployed workers & such assistance is beyond state's handling capacity.

Governor recently also awarded $73 million for forty housing projects to help 1,611 families rent or purchase houses in 26 California cities.

Some other projects have also been undertaken to negate the housing slump such as loans with low interest from Proposition 1C housing bonds for $69.5 million, $1.2 million public awareness campaign for homeowners on options which can be used in avoiding foreclosure, and providing assistance of $72 million to first time house buyers from funds available from federal HOME IPP (Investment Partnership Program).

Sunday, February 24, 2008

Bank of America putting David Sambol in charge of its mortgage business

David Sambol, president & chief operating officer of Countrywide has been placed in charge of Bank of America's combined mortgage business.

David Sambol, president & chief operating officer of Countrywide has been placed in charge of Bank of America's combined mortgage business.

But this decision has raised some eyebrows as he was the spearhead of Countrywide's lunge for growth. Sambol embraced company's pursuit of subprime mortgage loans which had turned Countrywide into largest mortgage lender in the country.

According to 4 current & former executives at the company, David Sambol had brushed aside warnings by company's risk-control managers that Countrywide's lending standards were too laxed.

Right now it is too soon to tell what Mr. David Sambol will be doing at BofA. Some people are sceptical of his appointment with Bank of America.

In a statement CEO of Center for Community Self-Help, Martin Eakes said -

Merger of mortgage companies

In East Bay 4 mortgage companies have merged with BWC Mortgage Services, situated in San Ramon to form a retail mortgage lender which will now have yearly origination greater than $2 billion. With this merger BWC Mortgage Services will be operating in 21 branches with more than 200 mortgage loan agents.

BWC Mortgage Services which is a former division of Bank of Walnut Creek provides multi-state licensing, FHA loans & mortgage banking.

The 4 mortgage companies that have merged with BWC Mortgage Services are; Paragon Mortgage Bankers of Alamo, Bay Area Funding Group of Danville (it was lending division of Re/Max Accord), Stonecastle Land & Home Financial of Danville and Concord branch of All California Mortgage.

Sunday, February 17, 2008

Capstead Mortgage reports 4Q profit

Good news for mortgage industry watchers; Dallas based REIT, Capstead Mortgage has posted a fourth-quarter profit. It has reported $15.9 million as net profit for 3 months ending December 31, 2007, same period last year it was at $2.35 million. In this 3 month period interest income also rose to $87.8 million which was $70.3 million last year.

Good news for mortgage industry watchers; Dallas based REIT, Capstead Mortgage has posted a fourth-quarter profit. It has reported $15.9 million as net profit for 3 months ending December 31, 2007, same period last year it was at $2.35 million. In this 3 month period interest income also rose to $87.8 million which was $70.3 million last year.

Its shares also rose by eight percent to $17.10 on volume of about 953,000 compared to a thirty day average volume of 865,000 shares.

Subprime mortgage loss assumption increased by S&P

For subprime mortgages which were originated in 2006, packaged into bonds & sold to investors, the credit rating agency - Standard & Poor's is increasing its loss assumption to 19% which was 14% previously because of increasing defaults for such mortgages.

For subprime mortgages which were originated in 2006, packaged into bonds & sold to investors, the credit rating agency - Standard & Poor's is increasing its loss assumption to 19% which was 14% previously because of increasing defaults for such mortgages.

This change has been planned as Standard & Poor's is altering the overall ratings assumptions that are used for reviewing collateralized debt obligations backed by MBS.

Debt & bonds originated in 2007, 2006 & 2005 are expected to be most affected as these are more sensitive to present market downturn.

Standard & Poor's has planned some other changes to assumptions:

It will extend stress-case losses scenarios which presently are run for thirty six months period to span entire life of bonds. This stress-case loss is a test of how bonds are going to perform under worst case scenarios, and

Excess capital that is placed in a deal for covering some portion of losses known as excess spread is also being revised by Standard & Poor's.

Wednesday, February 13, 2008

Plans by John Kerry on funding of mortgage refinances

In a press statement Sen. John Kerry said that it will be possible to refinance subprime mortgages taken by Massachusetts borrowers using tax-exempt bonds under economic stimulus package cleared by a U.S. Senate Committee recently.

In a press statement Sen. John Kerry said that it will be possible to refinance subprime mortgages taken by Massachusetts borrowers using tax-exempt bonds under economic stimulus package cleared by a U.S. Senate Committee recently.

Kerry said that, if the bond provision of the bill which has been developed as an economic stimulus package survives negotiations, it will mean that states would have near about $10 billion for use as tax-exempt bonds. These bonds could be used to help borrowers refinance their subprime mortgages into mortgages with lower rates.

Kerry also informed that communities that have been affected most due to recent foreclosures in Massachusetts like, Lawrence & Brockton will benefit as some share from $10 billion fund will flow into Massachusetts.

This proposed mortgage plan by Kerry & Sen. Gordon Smith has been praised by many including Thomas R. Gleason, executive director of MassHousing, which is a quasi-government agency.

This provision (called as Kerry-Smith provision) in the bill for tax-exempt bonds will help states sell another $10 billion as federally tax exempt mortgage revenue bonds. Part of these funds will flow through to agencies such as MassHousing which will then have more money to make available affordable mortgages for borrowers.

Commerce committee passes mortgage bill

Senate's Commerce Committee has passed the bill which has been created to strengthen monitoring system of mortgage loan originators in Oregon.

This bill (Senate Bill 1064) will empower Oregon's DCBS (Department of Consumer & Business Services) with regulating authority over loan originators in mortgage sales business commonly referred to as "bad actors".

Department of Consumer & Business Services will have the authority to take action against bad loan originators through increase in reporting standards & by increase in the scope of prohibited conducts to include acts on part of loan originators which reflect incompetence or negligence. And violators will have the risk of loosing their license.

Supporting the bill, Sen. Ben Westlund, D-Tumalo, committee's chairman has made a statement that:

Sunday, February 10, 2008

Mark Greene - FICO not to be blamed for mortgage mess

Some people are of the opinion that Fair Isaac, the company that developed FICO score and other companies which provide credit score, like, TransUnion, Experian & Equifax are to be blamed for present mortgage mess because their scores were not able to correctly predict subprime default risk.

Some people are of the opinion that Fair Isaac, the company that developed FICO score and other companies which provide credit score, like, TransUnion, Experian & Equifax are to be blamed for present mortgage mess because their scores were not able to correctly predict subprime default risk.

But Fair Isaac's Chief Executive Officer (CEO), Dr. Mark Greene does not agree with such thoughts. In a recent interview with cnnmoney.com's editor Paul R. La Monica he said that FICO score has performed well & is not to be considered as one of the causes of present mortgage crisis.

He does agree that there is scope for improvement. And in that context, Fair Isaac is about to release a new credit scoring product by May, named, FICO 08. This new credit scoring product will mainly focus on improving predictive accuracy of credit risk of borrowers who are known as subprime borrowers and also of borrowers with little credit history called as "thin file" borrowers.

According to Greene, Fair Isaac is also coming out in May with what has been named as Credit Capacity Index (CCI). This index will help banks calculate capacity of any prospective borrower of borrowing additional debt. This product will help banks & lending institutions correctly estimate any prospective borrower's creditworthiness.

Thursday, February 7, 2008

A few things about Interest Only Loans

The first chart above depicts monthly payment schedule for a interest only loan. Borrower pays only the interest in the initial loan period, & afterwards mortgage re-amortizes to pay the balance on the prinicipal amount of $100,000 over the remaining term of the mortgage.

Second chart shows that the principal amount remains constant during the I/O term & begins to decline when borrowers starts making principal balance payment.

Interest only mortgages are basically suitable for borrowers who;

- are trying to prevent negative cash flow during starting period of mortgage,

- expect their property to appreciate considerably

- plan to flip there property,

- have other section where cash is being used which they have to pay as principal.

Tuesday, February 5, 2008

Investigative hearings on Countrywide's acquisition by BofA

U.S. Congressional Banking Committees have been asked by 4 statewide consumer groups to hold investigative hearings on affect acquisition of Countrywide by BofA will have on its employees & borrowers.

Letters in this regard were sent to Barney Frank, Chairman of House Financial Services Committee (HFSC), & Christopher Dodd, Chairman of Senate Banking Committee (SBC), by the 4 consumer groups, namely, Neighborhood Economic Development Advocacy Project, New York (NEDAP), Community Reinvestment Association of North Carolina (CRA), New Jersey Citizen Action (NJCA), & California Reinvestment Coalition (CRC).

Josh Zinner, co-director of NEDAP in a statement said that -

Concerns are rising as BofA has not made public any particular plan which will ensure that efforts will be made to help borrowers keep their homes & local economies and neighborhoods remain intact. Congress has been urged to make sure that a plan is developed to include policies and staffing which will guarantee that borrowers are offered affordable fixed mortgages which will help them keep their homes.

Mortgage Forgiveness Debt Relief Act

In late December Mortgage Forgiveness Debt Relief Act of 2007 came into existence which is meant to provide tax help for people who are selling their house in a short sale or are facing foreclosure.

In late December Mortgage Forgiveness Debt Relief Act of 2007 came into existence which is meant to provide tax help for people who are selling their house in a short sale or are facing foreclosure.

Before this Act, if value of house declined & lender forgave any portion of your mortgage debt, according to tax code forgiven amount was treated as income and was taxable.

If it is your principal residence & not a investment property or second home then as per MFDR Act you can exclude up to $2 Million of mortgage loan debt forgiven in years 2007, 2008 or 2009. Additionally, this debt relief will be applicable for acquisition indebtedness only.

New Golden Opportunity Mortgage Program

A new mortgage loan is being offered by Cappelli Sales & Marketing named "Golden Opportunity Mortgage Program (GOMP)".

A new mortgage loan is being offered by Cappelli Sales & Marketing named "Golden Opportunity Mortgage Program (GOMP)".

Under this program new home buyers at 3 Cappelli developments in Westchester County are offered low rates of 4.875%. This low rate is for first 3 years & is followed by a 5.875% rate for the next 2 years.

The 5 year mortgage will be based on thirty year amortization schedule with loan for up to 80% ltv & will not have any origination fees, points or prepayment penalties. To qualify for the low interest rates, borrowers will have to commit in writing & lock-in rate in forty eight hours of date of contract's rescission.

Friday, February 1, 2008

Refinance Rush

Federal Reserve's recent rate cut has caused a rush in refinance activity among homeowners. 30 yr FRMs are now available at an average rate of 5.57% which is very close to the historic low of 5.21% in 2003.

Federal Reserve's recent rate cut has caused a rush in refinance activity among homeowners. 30 yr FRMs are now available at an average rate of 5.57% which is very close to the historic low of 5.21% in 2003.

Market Composite Index, which is known as a measure of application volume for mortgage loans from Mortgage Banker's Association (MBA) has gone up by 8.3% from where it was a week ago.

Refinance rush is expected to get further boost from the fact that an economic stimulus package has been proposed by government & because of which Freddie Mac & Fannie Mae will be able to buy mortgage loans worth much more than what is allowed presently.

In such scenario, it will become feasible for homeowners to refinance more expensive mortgages also.

Tuesday, January 29, 2008

Countrywide still the leading mortgage lender

Countrywide Financial Corp. is still country's leading residential mortgage lender.

In 2007, Countrywide (NYSE: CFC) had originated mortgages for $408.2 billion but it was down to what it originated in 2006. In 2006 it had originated $462.5 billion.

We look at the other leading originators last year:

In the ranking at number 2 was Wells Fargo & Co. & it had originated mortgage loans to the tune of $272 billion. Similar to Countrywide, the loan origination was down from what it was in 2006 - $398 billion.

Last year at number 3 spot was JP Morgan Chase & Co. with $207.7 billion in mortgage loan originations. It has been an improvement from 2006, when loan origination was $171 billion.

At number 4 was the Corp. which purchased Countrywide; Bank of America Corp. & it had mortgage loan originations for $188.6 billion, improvement from 2006 when it was at $166.3 billion.

Next at 5th position was Citigroup Inc., with originations up from $142.1 billion in 2006 to $151.9 billion.

Countrywide CEO to forfeit severance package

CEO of Countrywide Financial Corporation, Angelo Mozilo has announced that he is going to forfeit his severance pay & perks retirement package which would be close to $37.5 million.

CEO of Countrywide Financial Corporation, Angelo Mozilo has announced that he is going to forfeit his severance pay & perks retirement package which would be close to $37.5 million.

Mozilo has received quite a bit of blame for Countrywide’s present position & has also been scrutinized by SEC (Securities & Exchange Commission) regarding stock sales he had made.

Even after forgoing severance package, he will be left with lot of money as he is going to get a pension & executive retirement plan which in 2006 was estimated to be $23.8 million. Mozilo also has $5.8 million in company stock & $20 million in deferred compensation.

Monday, January 28, 2008

National Association of Realtors comments on economic stimulus plan

Federal Reserve Chairman, Ben Bernanke is in favor of use of short term economic stimulus measures to stabilize the current situation.

Federal Reserve Chairman, Ben Bernanke is in favor of use of short term economic stimulus measures to stabilize the current situation.

In this context NAR has suggested that some of the constraints on 2 GSEs (Fannie Mae & Freddie Mac) should be relaxed.

Dick Gaylord (NAR President) is of the opinion that conforming loan limits for the 2 GSEs should be increased. NAR wants the limit to be increased to $625,000 from $417,000. The President said that increasing the conforming loan limit would improve liquidity & boost buyer confidence levels.

Gaylord said -

Stanford Group estimates on the maximum loan size which can be guaranteed by Freddie Mac or Fannie Mae for high cost areas according to the stimulus plan by Congress :

Mortgage analysis firm enters cooperation agreement with AG's Office

Clayton Holdings Inc., a mortgage loan analysis firm has entered into an agreement with NY's AG in which it will provide information on how Wall Street firms had disregarded their warnings on quality of mortgage loans being sold to investors.

Clayton is country's biggest due-diligence firm which is hired by investment houses for ensuring that loan blocks are as per seller's own standards.

The firm has entered into cooperation agreement with AG's Office & will give details of what it knows about how firms had sold MIs (Mortgage Investments) even after they warned that the loans were not upto required quality standards.

In a statement released by the firm they have stated that they have also been asked regarding mortgage loans which had exceptions to seler/lender guidelines & were purchased by mortgage backed security issuers.

Sunday, January 27, 2008

Mortgage applications increasing

For some weeks now, number of people applying for a mortgage loan, be it for house purchase or refinance has been on the rise.

As per January 11 week ending report from MBA (Mortgage Banker's Association), mortgage activity has jumped to 28.4% week-over-week. It is slightly lower than the increase seen in week ending January 4 where the increase was 32.3%.

Additionally, new mortgage applications have gone up by 11.4% & number of people looking to refinance has increased by 43.4%.

Citigroup writedowns and Washington Mutual Layoffs

Citigroup has recently announced a substantial $18.1 billion writedown. From its inception 10 years ago, for Citigroup it was the first quarterly loss & was basically due to losses from subprime lending.

WaMu has also released bad news; it is going ahead with 2600 job cuts from their home loan section & another 550 from support & corporate positions. Company spokesman have also released information that they are expecting loan related losses to the tune of $1.8 to $2 billion in the first quarter of 2008.

Saturday, January 26, 2008

Mortgage rates falling

PMMS or Primary Mortgage Market Survey by Freddie Mac shows that mortgage rates are continuing to fall. The rates for 15 & 30 yr. FRMs are now at their lowest level since July 2005.

30 Yr. FRMs are averaging 5.69% & are down by 18 basis points. Last year these mortgage loans were at 6.23%. Similarly, 15 Yr. FRMs are at 5.21%, which were at 5.98% one year ago.

It is also the first time in 7 years that average rate of 15 yr. frms is at a lower point compared to average rate on 1 yr. arms.

Mortgage Bankruptcy Bill

The Mortgage Bankruptcy Bill was recently signed off by U.S. House Judiciary which tries to help bankrupt homeowners keep their homes. According to this bill, terms of existing mortgages can be changed by bankruptcy courts to help homeowners.

This proposed legislation is only applicable for sub prime mortgages & other non traditional mortgage loans like optional payment & interest only mortgage loans. In addition these loans should have been taken after

Those who support the bill have figured out the number of homeowners who will get help because of the legislation will be around one-half million.

Through this legislation courts will be able to:

- Cancel excessive & most often secret fees charged by unfair lenders.

- To reflect actual value of the house, modify mortgage’s principal amount.

- Remove harsh prepayment penalties and

- Bring down very high interest rates on the mortgage.

Mortgage Rate Trend

The following figure shows how different type of mortgages have been moving for the last 1 year. we can clearly see that most of them have lower rates compared to what they were 1 year ago.

Job cuts by National City Corporation

National City Corporation is going to eliminate 900 jobs and has also announced suspension of brokered mortgage operations.

This is going to be 2nd major layoff in little over a year & is going to affect one-seventh of its mortgage staff. In 2006, 2500 positions were cut when their mortgage lending and home equity operations were merged. They are also cutting its common stock dividend to .21 from .41 & have also planned seeking more capital for coping with credit market fluctuations.

Thursday, January 24, 2008

Schwarzenegger wants a raise in conforming loan limit

California Gov. Arnold Schwarzenegger has joined others in raising his voice for increase in conforming loan limit which currently is at $417,000. This is the present ceiling for mortgage loans which are eligible for guarantee or purchase by Freddie Mac & Fannie Mae.

California Gov. Arnold Schwarzenegger has joined others in raising his voice for increase in conforming loan limit which currently is at $417,000. This is the present ceiling for mortgage loans which are eligible for guarantee or purchase by Freddie Mac & Fannie Mae.

Arnold Schwarzenegger has urged for clearing of legislation to raise this loan limit to $625,000 (considered as jumbo loans) for markets called as high-cost housing markets. He made this request through a letter to congressional leaders & if the conforming loan limit is increased it would allow government chartered mortgage companies to have a major role jumbo loan market in California.

In the letter to House & Senate leaders Schwarzenegger said: